Many hoteliers are rationalizing Airbnb’s entry into the lodging space as non-competitive. As the hotel industry learned from the dawn of vacation rentals and online travel agencies, ignoring groups that fulfill lodging demand at scale is a bad idea. Airbnb is now operating at scale, and just getting started.

Airbnb takes an asset-light strategy to a new level, operating a digital exchange that matches individuals to individual lodging units. Airbnb has A-tier investors, smart management and a sizeable valuation. Its next funding round will value the company at over US$13 billion. As of mid-December, that put the firm slightly below Starwood (US$14.2 billion) but above Wyndham, InterContinental and Hyatt.

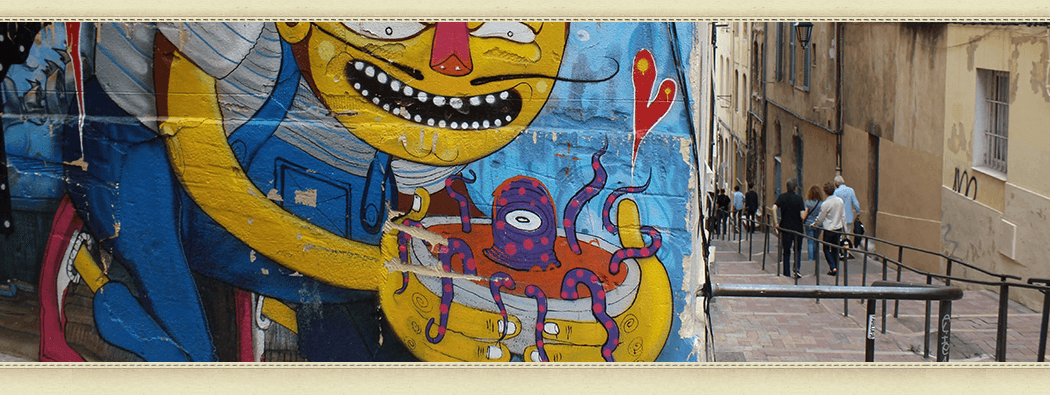

One single night, during July 2014, Airbnb housed 330,000 total guests (20,000 in Paris alone). It should be noted that Airbnb offers three distinct types of product – host present/shared rooms, host-present/private rooms, and host absent/full unit stays. The third option may be most directly competitive to hotels, but as mainstream travelers become more familiar with Airbnb, traditional hotel guests, particularly Millennials, may start considering alternatives. The biggest difference, however, is the guest experience. Airbnb’s ultimate goal is to provide a great host to guest match. When it works, visitors are no longer tourists; they live like a local and get an expert insider perspective on local experiences that can make a stay truly unique and memorable.

Airbnb disrupts the hotel industry not only by introducing supply at a lower price point, but also while enhancing the guest experience through personalization. That improved value proposition is the future battleground for traditional hoteliers. To successfully compete with Airbnb, hoteliers must ask “why“ guests are staying and organize service delivery standards to offer unique guest experiences – just like Airbnb.